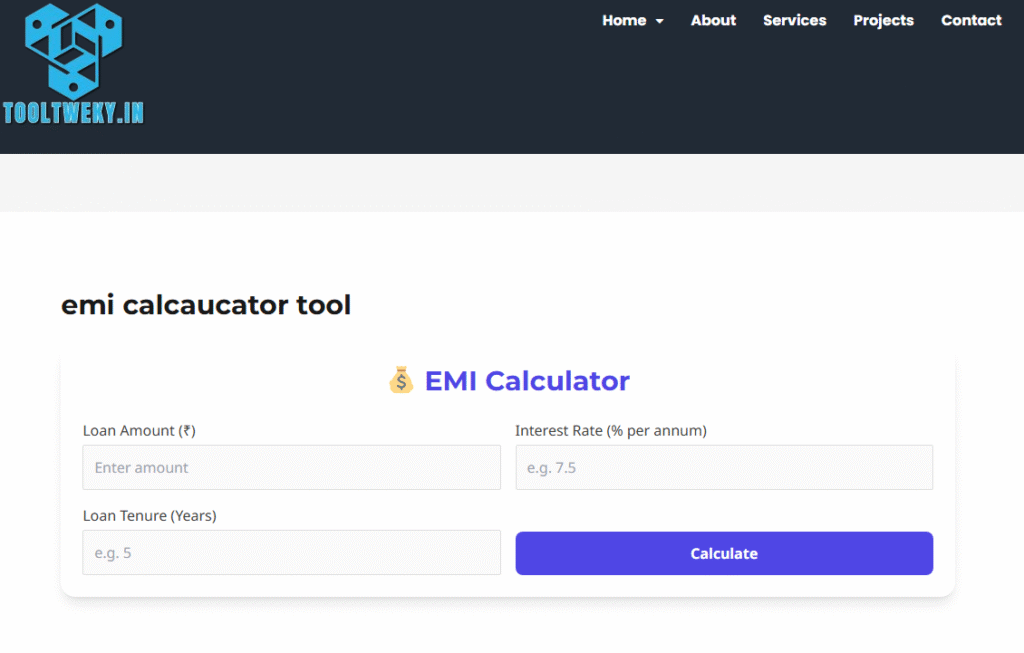

💰 EMI Calculator

EMI Calculator: The Smart Way to Plan for a Loan

Imagine you want to buy a new laptop for your studies, a car for commuting, or are just thinking about a future home loan. These big purchases often require taking a loan from a bank. But how do you know if you can afford the monthly payments? This is where an EMI Calculator becomes your best financial friend. EMI stands for Equated Monthly Installment. It’s the fixed amount you pay to the bank every month until your loan is completely repaid. An EMI calculator is a free online tool that instantly tells you this exact amount, helping you plan your budget without any confusion or surprise.

Using an EMI calculator is incredibly simple and requires just three basic pieces of information. First, you enter the Loan Amount or Principal—the total money you plan to borrow. Next, you input the Loan Tenure—the number of months or years you want to repay the loan over. Finally, you add the Interest Rate offered by the bank. Once you click the ‘Calculate’ button, the tool instantly works its magic.

Why is this so important? Because an EMI calculator empowers you to make smart financial choices. You can experiment with different tenures and amounts to find a monthly payment that fits comfortably within your budget. For example, you might find that a slightly longer tenure significantly lowers your EMI, making that dream purchase more affordable right now. It brings transparency to the loan process, allowing you to see the true cost of borrowing and compare different bank offers side-by-side.

Questions & Answers (Q&A)

Q: What does EMI stand for?

A: EMI stands for Equated Monthly Installment. It is the fixed amount you pay to your bank or lender every month until your loan is fully paid off, including both the principal amount and the interest.

Q: Is using an online EMI calculator free?

A: Yes! All online EMI calculator tools are completely free to use. Banks and financial websites provide them to help customers plan their finances better.

Q: What is the main benefit of using an EMI calculator?

A: The biggest benefit is financial planning. It helps you know your exact monthly commitment before you even apply for a loan, ensuring you don’t take on a debt that strains your monthly budget.

Q: What is the difference between reducing balance and flat interest rate?

A: A reducing balance method calculates interest on the remaining loan amount, which decreases over time. A flat interest rate method calculates interest on the full original loan amount for the entire tenure. Reducing balance is fairer and most common; always ensure your calculator uses this method.

Q: Can I use an EMI calculator for any type of loan?

A: Absolutely! The same mathematical formula applies to most common loans, including education loans, home loans (mortgages), car loans, and personal loans. Just make sure to use the correct interest rate and tenure for that specific loan type.